Disappearing income: how student jobs have vanished during the pandemic

May 15, 2020

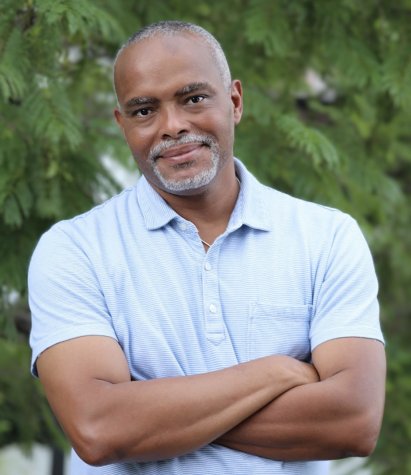

When sophomore Darian Myers left for a spring break trip to Prague to visit their partner studying abroad, they did not expect to be out of work for several weeks upon their return.

As a full-time student who financially supports themself, Myers says they pay $635 in rent every month, in addition to other expenses, like tuition, food and transportation.

Prior to break, Myers was working 50 hours a week through their jobs at a daycare center, the Museum of Fine Arts, the Holmes Sports Center at Simmons and Strong Women, Strong Girls.

When they returned to the U.S., each of the four jobs they used to pay their expenses quickly disappeared.

Shortly after their return, Myers says the daycare center they worked at told them they had to quarantine for 14 days before returning to work.

In a span of four days that same week, Myers learned they could no longer work at the MFA or the sports center and that Strong Women, Strong Girls had cancelled programming for the rest of the semester.

According to Myers, the daycare center they worked at announced on March 18, that they would be closed until April 27. Now, Myers says the center says it will not open until at least June 29.

“At that point, I didn’t know when I would have an income again and for someone who fully supports themselves, that’s super scary,” said Myers.

Myers has continued to live at their apartment in Boston since they returned from Europe. But they say the cost of their apartment, along with other expenses, can be a stressor.

The daycare center offered employees positions at “hub centers,” where childcare workers watch the children of essential employees, according to Myers. By the time Myers completed their 14-day quarantine, all the positions at hub centers had been filled.

Eventually, Myers landed a nannying job where they now work 18 hours per week. Because they are earning significantly less money than they were before spring break, Myers sought out sources of financial relief.

Despite working more than 40 hours per week, Myers’ application for unemployment insurance was denied. Two of their four jobs were work study positions, which do not qualify for unemployment insurance, according to the Massachusetts state government’s website. Their non-work-study jobs did not bring in enough income this year to qualify for unemployment, according to Myers.

They were, however, able to receive financial relief from the federal and state Pandemic Unemployment Compensation, the CARES Act and the Simmons Support Our Students (SOS) Fund.

Now, Myers says they’re receiving as much money as they were prior to the pandemic, but it took weeks without pay to get here. Even still, Myers says they’re unsure how long the money flow will last.

“I’m stressed out about the state running out of funds. Even though I’m not working for my money right now, I’d rather be because it’s more secure,” said Myers.

Associate Professor of Political Science & International Relations Ben Cole says it is highly unlikely that the state will run out of funds, but it will look for other areas where it can cut costs.

Myers is not the only college student that has been financially impacted by the coronavirus. In fact, a recent poll from College Reaction and Axios found that over 55% of college students are moderately to very concerned about the pandemic’s effect on their personal finances.

Unlike Myers, many students did not receive federal stimulus checks from the CARES Act. Any student who was claimed as a dependent on tax filing in 2019 is not eligible for a $1,200 federal stimulus check, according to the IRS.

The College Reaction and Axios poll also found that among college students who were excluded from stimulus checks, 41% said need it and 25% said they desperately need it for their financial wellbeing.

Similar to Myers, many students rely on work-study positions as a source of income and are not eligible to receive unemployment benefits for those positions. In 2017, 1.2 million students in the U.S. participated in the federal work-study program, according to Huff Post.

Aside from work-study jobs, the industries that have been most affected by COVID-19 employ a large amount of young people. Workers 16-24 make up 24% of employment in higher-risk industries overall, according to the Pew Research Center. Among the 19.3 million workers in that age group, nearly half are employed in service-sector establishments.

Of all the sources of financial relief Myers sought out, they said accessing money from the SOS Fund was the easiest.

“That was the first time as a low-income student I’ve felt supported by Simmons,” said Myers.

Nearly 400 students, the size of an entire class year at Simmons, have applied for grants from the SOS Fund, according to Echelle Avelar, assistant dean for community standards. Avelar says grants from the fund range from $100 to $800, depending on a student’s situation.

Myers says they are searching for more work for when classes end, but they are hitting roadblocks. Most families are afraid to hire a nanny or babysitter who already works with another family, according to Myers.

So, until the Massachusetts stay-at-home advisory restrictions ease and Myers can find more work, accessible financial relief, like the SOS Fund, can make all the difference.