By Olivia Hart

Staff Writer

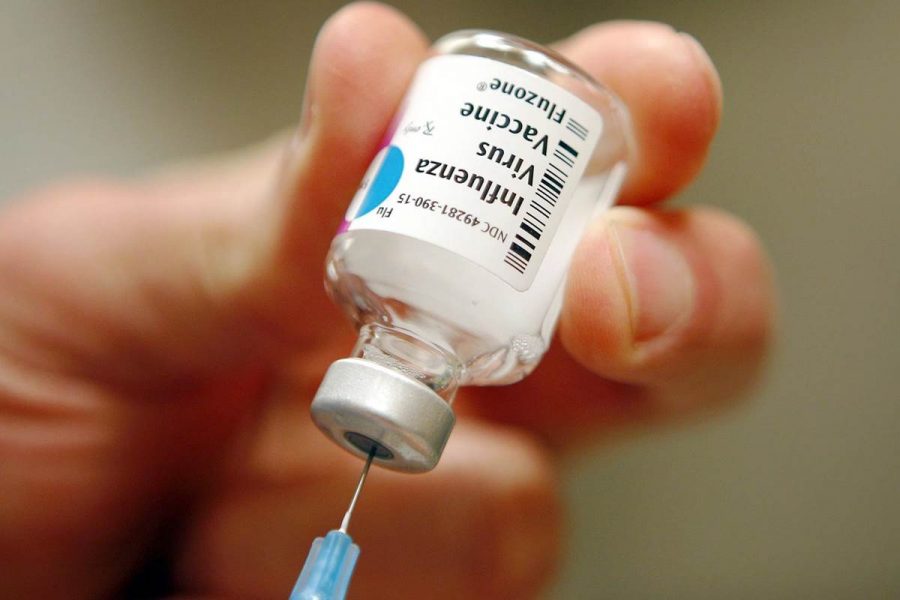

Senate Republicans proposed to repeal an Obamacare mandate requiring that most individuals in the United States have health insurance, in hopes to re-allocate government revenue to support tax cuts. Announced on Tuesday, this repeal will be included in a tax bill scheduled to be reviewed and voted on by the entire Senate before Thanksgiving. The Senate tax bill will eventually be combined with the House of Representatives’ tax bill before going to the President to sign into law.

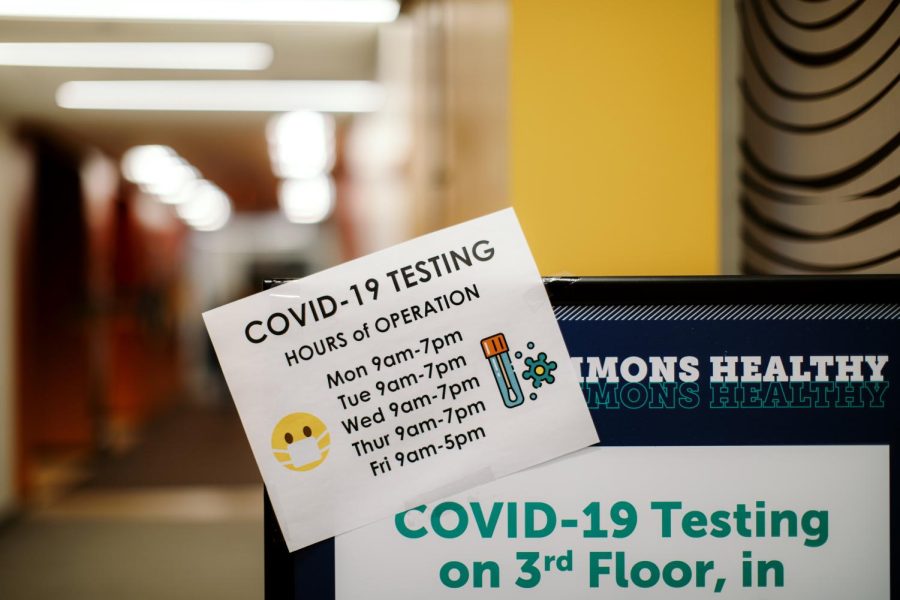

Under Obamacare, many Americans receive health insurance through government programs such as Medicare and Medicaid, or through their employer. People who do not fall under either of these categories must buy their own individual health insurance to abide by the 2010 Obamacare mandate. If they fail to purchase their own health insurance, they must pay a penalty tax of 2.5 percent of their gross annual income to the government.

The government often assists in these individual health insurance payments by offering subsidies (financial grants). The repeal of the Obamacare mandate would free up around $300 billion in government money over the next decade, since the subsidies would no longer be required. That $300 billion could mean lowered taxes in other areas for Americans.

John Thune, (R-S.D.), a member of the Senate committee drafting the tax bill that includes the repeal, said that the $300 billion will be “distributed in the form of middle-income tax relief.” This will take the form of decreased taxation for individuals and businesses, a top priority of the Republicans in the Trump administration. Thune is optimistic that the bill will be approved by Senate Republicans.

Further discussing the plans for redistribution of that $300 billion, Kentucky Senator Rand Paul—though not a member of the finance committee—tweeted that the mandate repeal would “provide bigger tax cuts for middle income taxpayers,” adding, “The mandate repeal is a promise we all made and we should keep.”

Paul also argued that the repeal would create more flexibility to adjust other government finance plans when the Senate tax bill is combined with the House of Representatives’.

Senator Tom Cotton (R-Ark.) led the push to include the mandate in the Senate tax bill.

“Repealing the mandate pays for more tax cuts for working families and protects them from being fined by the IRS for not being able to afford insurance that Obamacare made unaffordable in the first place,” Cotton said in a statement.

Arizona Sen. John McCain, who opposed the previous Republican effort to repeal and replace Obamacare in July, supports the new mandate repeal. President Donald Trump also voiced his support.

Senate Majority Leader Mitch McConnell (R-Ky.) said, “We are optimistic that inserting the individual mandate repeal would be helpful, and that’s obviously the view of the Senate Finance Committee Republicans as well.”

However, many political figures take issue with the repeal, as it would leave about 13 million Americans without health insurance according to the nonpartisan Congressional Budget Office.

Maine Sen. Susan Collins, who also voted against the previous Obamacare repeal effort in July, shared her concerns about the repeal.

“I personally think that it complicates tax reform,” she said.

Ron Wyden (D-Ore.), the leading Democrat on the finance committee, opposed the mandate repeal.

“Republicans are choosing to pay for corporate tax cuts by raising premiums for middle class families and ripping away health care altogether from millions more,” he said.

Senate Minority Leader Charles Schumer (D-N.Y.) argued, “Republicans just can’t help themselves. They’re so determined to provide tax giveaways to the rich that they’re willing to raise premiums on millions of middle-class Americans and kick 13 million people off their health care.”

The House’s tax bill, on which chamber members will vote on Thursday, does not contain the same mandate repeal. However, both the House and Senate must submit identical tax bills in order for it to be signed into law. Further debate in Congress will continue until the bill reaches the President’s desk.