Sunrise Simmons continues push for divestment

November 23, 2022

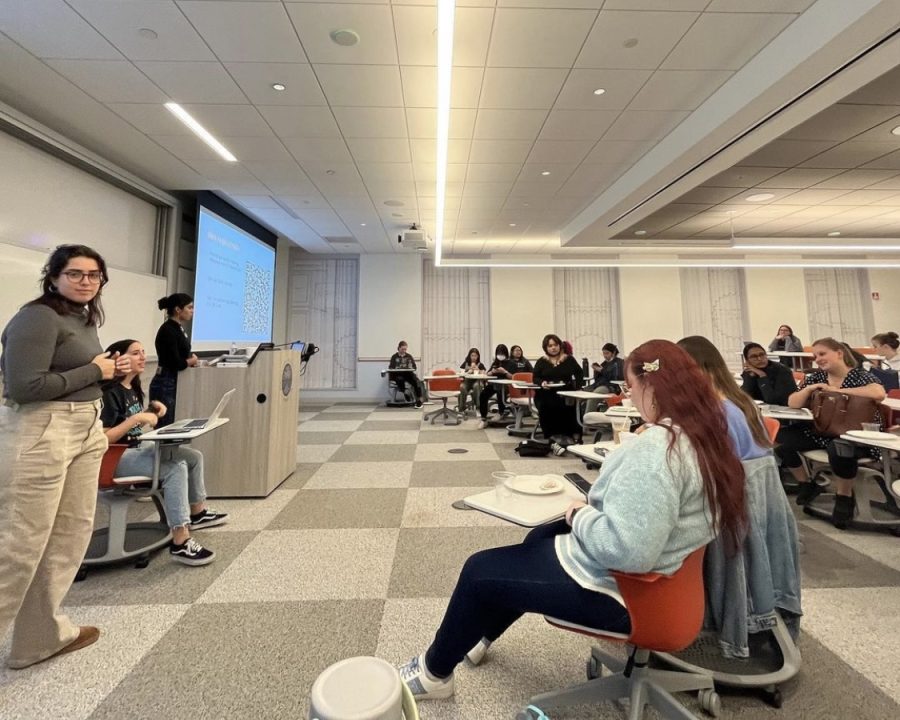

Sunrise Simmons, formerly known as the Simmons Sustainability Club, hosted a town hall meeting on Monday, October 17 speaking to students and other members of the Simmons community about divestment from fossil fuels.

In a proposed memo, Sunrise Simmons is calling for the University to divest from fossil fuels.

According to Sunrise President Milena Chaufan, the organization hopes that Simmons “sells their stocks in fossil fuels and reinvests their money in more sustainable practices, such as renewable energy.”

“Divestment is a verb–it’s an action,” says Student Government Association (SGA) President Megan Watras, a senior double majoring in finance and economics. “It means to remove your investments from something.”

“Fossils fuels are fuels that originated millions of years ago from animals and plants decaying in the air to give oil and natural gas and coal,” says Sunrise’s Faculty Advisor Professor Michael Berger.

Fossil fuels create “carbon-rich deposits that are extracted and burned for energy,” and were the source of 89% of global CO2 emissions in 2018.

Students say they believe divesting from fossil fuels is the morally sound choice for the University to make. “It’s important to respect the ground that we came from and that we’re going to,” said a member of the crowd during the town hall discussion.

Professor Berger says that divesting from fossil fuels “would be consistent with (Simmons’) focus on equity and social justice.”

Simmons’ current Mission & History statement includes the following: “At Simmons, we value the many dimensions of identity and reflect that in our curriculum, affiliated organizations, and community partnerships.”

Chaufan shares the belief that divesting from fossil fuels is in accordance with the Simmons mission, going on to say that the climate crisis is disproportionately affecting marginalized communities.

“Investing in fossil fuels will support the industry, which further endangers these communities and those who are part of these communities at Simmons,” says Chaufan.

“(The campaign has) been led by students entirely,” says Professor Berger. He also mentions that the movement to divest from fossil fuels has gained momentum within the last “three or four years.”

Sunrise often references Divest Harvard’s campaign because of how “recent and local” it was, according to Chaufan.

In September of 2021, Harvard announced that it would end its investments in fossil fuels.

A statement from Harvard President Lawrence Bacow made on Sept. 9, 2021 includes the sentiment that the University’s endowment managers don’t intend to make any more direct investments in companies that work within the fossil fuels industry.

“An endowment is a sum of donations that a University or nonprofit has,” says SGA President Watras.

Universities will use endowments to “increase student financial aid, make commitments to senior faculty, develop stronger teaching programs,” and more, according to the American Council on Education.

Simmons’ endowment “was valued at $244.3 million at June 30, 2021,” according to a statement from Chief Financial Officer Meghan Kass following the release of Simmons’ 2021 financial statements.

Aside from Simmon’s April 28, 2021 announcement that 10 million dollars would be invested in Metis Global Partners, “There has been no other amount disclosed to the public,” says Chaufan. This investment accounts for approximately five percent of the endowment.

At the time of publication, the Voice was unable to confirm with Univeristy officials the percentage of the investments disclosed.

Sunrise is calling for the University to be transparent about whether or not it uses any of its endowment to invest in the fossil fuel industry.

Watras emphasizes that divesting from fossil fuels might be a bit of a challenge in the short term, but should be a long-term goal for Simmons.

“We don’t know what it will mean for the next 10 years because we don’t really have the infrastructure to support clean energy to not be volatile,” she says.

Chaufan recognizes the challenges that come in taking action that will not show immediate results, but wants to move forward with the campaign regardless. “We are hoping that Simmons will commit to divestment in the near future. Committing to divestment doesn’t mean that this will happen in the next couple of years.”

Sunrise met with the Vice President of Student Affairs Dr. Renique Kersh and Chief Financial Officer Meghan Kass on Nov. 10 to discuss the next steps.

“Our CFO shared Sunrise’s memo with members of the Simmons Board of Trustees’ Investment Committee,” according to a statement from Assistant Vice President of Communications Laura Wareck. “The Investment Committee appreciates students leading on this issue and are looking forward to a potential meeting with Sunrise representatives during the spring term to further discuss.”

At the time of publication, the Voice was unable to confirm with Univeristy officials the percentage of the investments disclosed.